Work Life Financial Rewards & Goals are not always simple. Life is complex. Family, medical, mental and physical health just to name a few. Unplanned or unexpected things can happen. A few changes can make a big difference...

For the “Work Life Financial Rewards & Goals” lets finish the “Monthly Goals” row.

In terms of financial tasks this has a significant impact on most of us daily. We are bombarded with demands for money from a never ending source of people, family, friends for sometimes very good reasons or causes yet we have little extra money. These financial and financial mental health issues affect all or us in almost all aspects of our lives.

Financial health is both physical and mental. If you can get the financial health stabilized you have time for other benefits such as physical, mental, and relationship health including family. You also have more time for things that are very important to you including sport, friends, events, trips or whatever makes your life the best it can be.

Monthly Goals

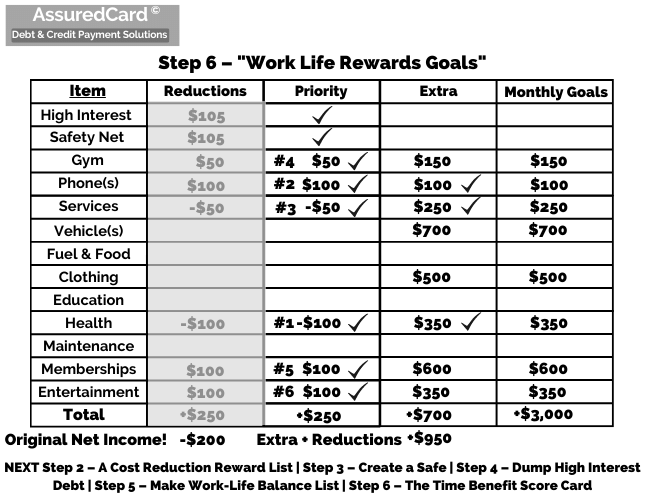

Create monthly goals. So next add the “Priority” and “Extra” with Checkmarks to get a based number for your achievements. In this example template we have achieved +$950 monthly available cash. Our goals is actually $3,000.

Create a new list monthly or even weekly. This is a game changer if you follow through on these items to being “Monthly Goals”.

We used this to quickly assess solutions for our customers and they made it easy with just 15-20 minutes of work. Then our account managers or representatives would find solutions in almost all circumstances.

We had two audiences at AssuredCard, one was the Customer and the other was Financial Institution or Services Companies.

Customer

For the customer we made all efforts to keep their information private. The only information we had from them was in the Work Life Financial Rewards & Goals sheet which we protected as if it was secret bank information. We would ask for permission to share this with any financial services firms registered with us to help our customers. If approved by the customer we would send this simple list and requested a proposed credit line or loan. It was a novel approach and worked very effectively.

Financial Services Firms

We asked the financial services firms to register if they accepted our program. If they did we registered. We did not want any of the customers financial information except the account or card they needed assistance and the Work Life Financial Rewards & Goal sheet. It was a novel approach that worked and could be needed again today.

A Plan Can Only Work If You Try!

A plan can only work of you try. It is important to update once a month. This solution worked for many and it could work for you. We hope it is a solution we used for so many, to relieve some of you financial stress! Wizard Page!

Step 1 – Simple Income Expense Number

So first let’s establish a starting point. A simple income and expense number. Step 1 Click here..

Step 2 – Expense Reduction Rewards List

Add a Reduction Rewards List that can make your day and life better. Add fun lifestyle ideas to you day replacing stressful expenses. Step 2 Click here...

Step 3 – High Interest Debt Reduction Solutions

Say Goodbye to High Interest Debt and Hello to Better Days Ahead! Simple switch and change ideas can make a big difference in your monthly finances. Step 3 Click here...

Step 4 – Safety Net Plan

Peace of mind is something we are always striving for, and having a Safety Net helps. Leverage the benefits of getting rid of High Interest Debt in Step 4 by creating a Safety Net Account. Step 4 Click here...

Step 5 – Time Benefits Score Card

You time is worth something, always. Make it worth more every penny every day with simple tips and tricks to make you life journey better. Step 5 Click here...

Step 6 – Work Life Financial Rewards & Goals

This is great! You are now positioned to make things better for yourself and your loved ones with balance, better health and less financial stress. Step 6 Click here...