This is an item with many options available. Just search low interest cards or loans. So think from the position of a lender then you can see how they are going to meet your needs. You can make a plan and if they see your are going to make it they can help…

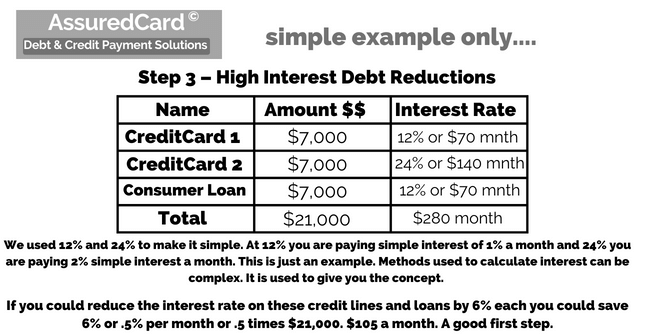

Here is a simple method. Sum up all the principle debt amounts. Use the second mortgage rate in your area. Deduct that from the interest rate of these debts. Times the debt the interest rate and that is what you could save if you reduced this high interest cost monthly. We have used an example saving of $105 a month using a 6% reduction. It could be $100’s of even $1,000’s depending on your situation.

Interim solutions could be low interest balance transfer credit card; bundle up consumer loans into lower rate credit facilities; high interest debts into a new second mortgage or equity loans. There are many possibilities just remember you are trying to reduce so be careful what you are given options they actually reduce and ask for proof.

IMPORTANT NOTICE: Make the calls or send emails based on your search. Apply only after you know you will probably be accepted as applying many times without acceptance can have the effect of reducing your credit worthiness for most rating agencies.

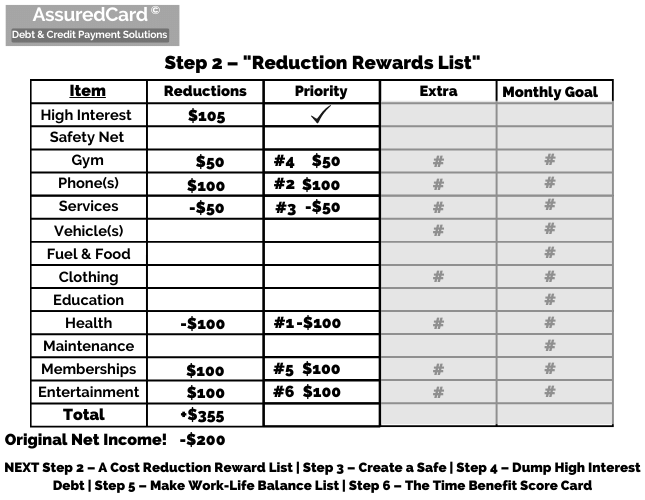

You will notice on the top row an Item called “High Interest” and beside it “Reductions”. This is important. You can calculate the savings you can make each month by lowering your interest rate of “High Interest Debt" and add it here as a potential reduction and check when achieved.

If lenders see they will get their money back or a higher probability than the interest rate is reduced. This is important for the list and your financial health. You will understand on Step 6 why we had our customers create this “Work Life Financial Rewards & Goals” plan.

So make a list of high interest business loans, educational, credit card, consumer, auto, equipment or other nigh interest loans sheet. Highlight the ones with interest that is significantly greater than a second mortgage and estimate what you can save.

Next – Safety Net Planning

The next Step 4 is important and interesting. If you save $105 from reducing High Interest Debt why not apply that to a Safety Net account or piggy bank. Lets go to Step 4... Click here...

Step 4 – Safety Net Plan

Peace of mind is something we are always striving for, and having a Safety Net helps. Leverage the benefits of getting rid of High Interest Debt in Step 4 by creating a Safety Net Account. Step 4 Click here...

Step 5 – The Time Benefits Score Card

You time is worth something, always. Make it worth more every penny every day with simple tips and tricks to make you life journey better. Step 5 Click here...

Step 6 – Work Life Financial Rewards & Goals

This is great! You are now positioned to make things better for yourself and your loved ones with balance, better health and less financial stress. Step 6 Click here...

Step 1 – Simple Income Expense Number

So first let’s establish a starting point. A simple income and expense number. Step 1 Click here..

Step 2 – Expense Reduction Rewards List

Add a Reduction Rewards List that can make your day and life better. Add fun lifestyle ideas to you day replacing stressful expenses. Step 2 Click here...

Step 3 – High Interest Debt Reduction

Say Goodbye to High Interest Debt and Hello to Better Days Ahead! Simple switch and change ideas can make a big difference in your monthly finances. Step 3 Click here...