This is the start of your Work Life Financial Rewards & Goals Plan. Long name that should make sense in a few minutes.

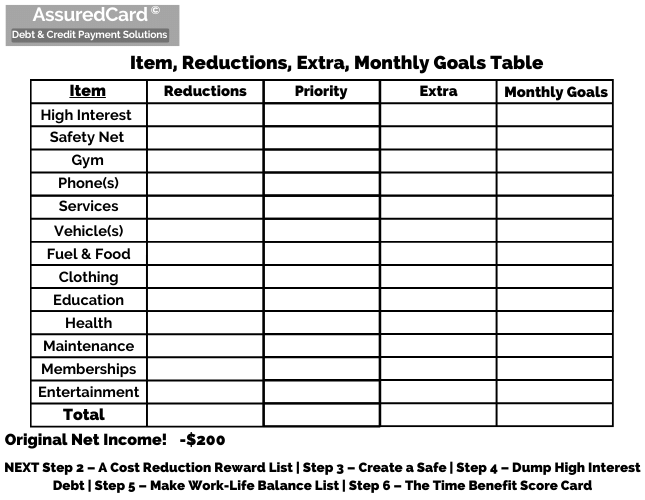

Create a five column list and label the five columns as follows: Item; Reductions; Priority; Extra; and Monthly Goals.

It can have as many rows as you need. Twenty should work for most. Now add you net cash income below the last Total as a note. In the image below labeled “Original Net Income”.

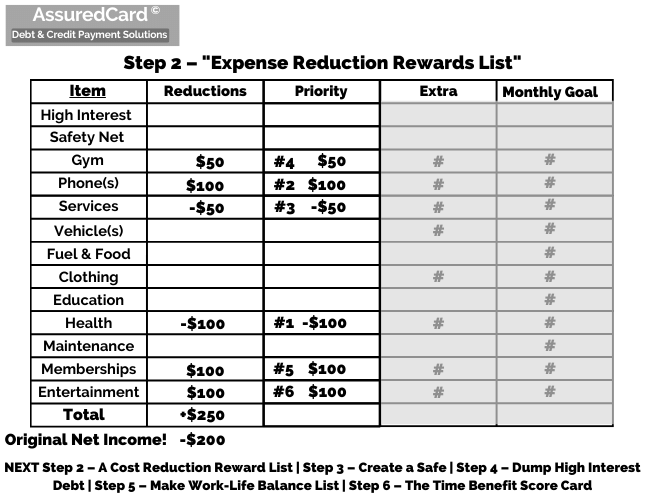

This list is to create options for you. Giving yourself an opening on what may or may not be top level important to you for financial and lifestyle optimization. We have filled some of the items in with template numbers so you can see how to create.

In this sample template list are additional monthly expenses such as: gym; phone; vehicle maintenance; fuel; transportation expenses; clothing; children’s education; children’s activities; household maintenance; club memberships; and entertainment subscriptions.

For example are you paying for gym memberships you are not using? Use that and apply to money you need for utilities. Give them a call and cancel you are paying yourself. Reduce monthly mobile expenses by switching plans and save $100. There are so many competitors and maybe you get a new phone for switching and keep your number. Same goes for internet and other services. Any other expenses you think you could reduce of eliminate and with options and ideas. Write them down.

Another idea save money on memberships and entertainment you barely use and add to your health budget for you or your family. Now prioritize.

Prioritize Items

Select items you can reduce quickest and give them a call. Once you get one done you will see how easy and time saving it can be. Maybe do one a day or if you have time go through them all. Place a check mark once you are finished.

The biggest take away is understanding you are the one with the power to make these changes and create a more enjoyable and stable future and life.

Next – High Interest Debt Reduction Solutions

In this list expense item under “Reductions” place the amount you can reduce. Under “Priority” place the order you think best. Step 3 Click here...

Step 3 – High Interest Debt Reduction Solutions

Say Goodbye to High Interest Debt and Hello to Better Days Ahead! Simple switch and change ideas can make a big difference in your monthly finances. Step 3 Click here...

Step 2 – Expense Reduction Ideas

Maybe you like outdoor activities like going to a park, watching or coaching school sports, meeting friends for coffee instead of drinks and reduce paid entertainment or memberships expenses.

Getting involved with local clubs and charities including sports and arts can help you meet new people and add community value or find new ideas for extra income.

Meals are another potential project for fun that can have real benefits. Ahead of time make a lunch if you are working outside your residence. Take them to work making healthy food your meal instead of processed food, which can help both your pocketbook as well as your health. This can also have other benefits like reducing the time to dine out with people you do not want to see and having time for relationships with family or someone you want to connect.

Looking for options for car expenses including utilizing public transportation to save cost of fuel, walking, or saving ahead and paying cash for a car rather than purchasing one with a loan can work as well.

When you have time finding these new options writing them down on the first list. projects and ideas can make your life better and finances less stressful.

Step 4 – Safety Net Plan

Peace of mind is something we are always striving for, and having a Safety Net helps. Leverage the benefits of getting rid of High Interest Debt in Step 4 by creating a Safety Net Account. Step 4 Click here...

Step 5 – The Time Benefits Priority Score Card

You time is worth something, always. Make it worth more every penny every day with simple tips and tricks to make you life journey better. Step 5 Click here...

Step 6 – Work Life Financial Rewards & Goals

This is great! You are now positioned to make things better for yourself and your loved ones with balance, better health and less financial stress. Step 6 Click here...

Step 1 – Simple Income Expense Number

So first let’s establish a starting point. A simple income and expense number. Step 1 Click here..

Step 2 – Reduction Rewards List

Add a Reduction Rewards List that can make your day and life better. Add fun lifestyle ideas to you day replacing stressful expenses. Step 2 Click here...