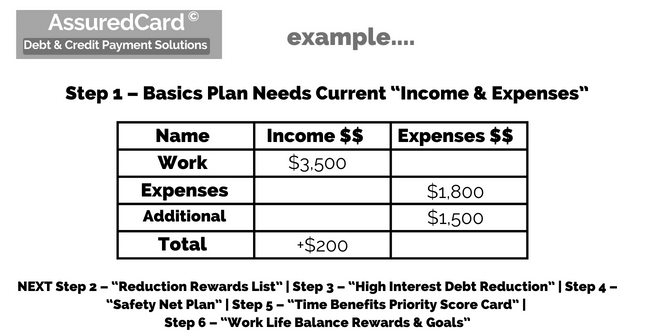

Step 1 - Net Income Pay Period Monthly Cash

Create a simple income expense sheet with basic net monthly pay period cash.

To achieve the lifestyle you desire we need to create a full solution, first step initial numbers so you can see your progress or where you could make more improvements.

All types of financial health planning including consideration for family and friends relationships can be part of this plan. It is all up to you. Additional income or alternatives in the future you can adjust. This is simply a template. Add or adjust as you need. For now create a starting point.

Simple Income & Expense Sheet

Monthly Income A working budget and what you can do to make it work for you. How much money you have to work with each month.

- List of Expenses Mortgage payments, car notes, utility bills, credit cards, and include fun stuff like club memberships and entertainment subscriptions. They are needed for a good work-life balance and all add up.

- Other Expenses List your vehicle maintenance, fuel, transportation expenses, clothing, children’s education, children’s activities, and household maintenance.

Now Subtract the expenses from your income. No matter what the result you have a starting point. Well done. Now take a deep breath and go to the next step.

NOTE: Making a few adjustments can make a big difference. Make changes and you can achieve financial stability. Have the life you want and deserve.

Next – Expense Reduction Rewards List

Now lets create an expense reduction rewards list so you can see what is possible. Step 2 Click here...

Step 2 – Expense Reduction Rewards List

Add a Reduction Rewards List that can make your day and life better. Add fun lifestyle ideas to you day replacing stressful expenses. Step 2 Click here...

Step 3 – High Interest Debt Reduction Solutions

Say Goodbye to High Interest Debt and Hello to Better Days Ahead! Simple switch and change ideas can make a big difference in your monthly finances. Step 3 Click here...

Step 4 – Safety Net Plan

Peace of mind is something we are always striving for, and having a Safety Net helps. Leverage the benefits of getting rid of High Interest Debt in Step 4 by creating a Safety Net Account. Step 4 Click here...

Step 5 – The Time Benefits Priority Score Card

You time is worth something, always. Make it worth more every penny every day with simple tips and tricks to make you life journey better. Step 5 Click here...

Step 6 – Work Life Financial Rewards & Goals

This is great! You are now positioned to make things better for yourself and your loved ones with balance, better health and less financial stress. Step 6 Click here...

AssuredCard Wizard - Work Life Balance Rewards & Goals

Financial stability is something almost all of us desire. The need to deliver a solution to reduce financial stress and deliver a good work life balance the reward for you. During our launch the reward for efforts philosophy was the most effective model to get customers to complete the 6 Steps and help them find a solution!.. Click here...

Step 1 – Simple Income Expense Number

So first let’s establish a starting point. A simple income and expense number. Step 1 Click here..