AssuredCredit | AssuredCard | MIlinx | Online Secure Application & Registration Gateway

Assured Card Corporation knew to maintain a market share for it's unique credit and debt management product it had to create technology that would provide efficient operation and reach globally. It also had to be more secure than financial institutions.

The future was online so a technology development division called AssuredCredit was created. The focus was to create a secure online portal for applicants to apply or register online and make payment requests.

Technology quickly developed and we expanded our scope to include a web portal framework for anyone with internet access including a Netscape browser to quickly apply for services, send payment requests and possibly pay the $29 annual payment online.

The initial focus was to reduce costs. We had two manual data cost centers:

- production, distribution and processing of prepaid mail envelopes for paper application forms

- data entry with secure access protocols and secure storage of paper application forms

The manual handling of paper applications and registrations was a security risk we could monitor physically. Online and digital forms needed a higher level of surveillance on security technology and we needed to build ourselves what did not exist.

It was 1998 and the technology easiest to adopt was ActiveX as Microsoft Internet Explorer had 80% of the marketplace. ActiveX was proprietary to Microsoft which was an issue.

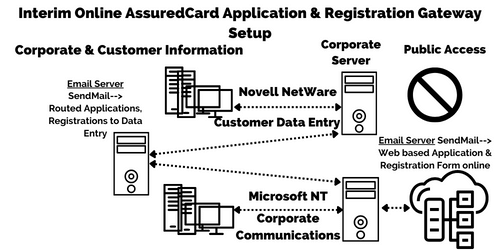

The interim solution to get the form working was using an email server and SendMail on the front end which was a new technology in 1998. The application or registration would digitally send the application text to the department handling customer data, to enter a new lead or customer without paper.

The interim Application, Registration & Payment Request model was designed to keep the Client information as secure as possible. The email server forwarded the request to Account Managers based on email routing and stripped the form of any active code. Just text.

There were two routing models:

- Application & Registration

- Payment Request

We segregated the work into two groups. One for simple data or new lead entry and the other for onboarding of new Clients. We did not transmit any financial data using this digital framework.

We had used the updated CRM model from SuccessInc to hold information usintg PC's in a database. It was not internet connected and that was a problem. We needed to setup a secure gateway for Online Registration and Payment Requests. Microsoft had added ActiveX controls to HTML for Internet Explorer with Jscript (versus Javascript) so we created a custom page that would download the browser and send the data directly to the data base. We also added an interim solution for the website and SSL being an in-house web server. We also limited the data collected from the online form.

Again the challenges with Internet Explorer continued. There was a real difference between ActiveX and Sun’s Java technology including everything Microsoft was created was proprietary at that time.

The issues with ActiveX controls included anyone could run almost anything on the Microsoft OS of the browser user without restrictions. With Sun Java technology it was designed without any real limits on operating systems and Java had a more granular access control. Both had flaws. Microsoft ActiveX security issues were exponential versus Sun's Java approach.

AssuredCredit was tasked with creating and managing a secure online form. During this process development started on a universal payment gateway.

AssuredCard was created to help consumers with credit issues. We created a Microsoft custom Windows Form using HTML & Jscript for the Registration Application form. To reduce potential malicious activity the form used SendMail function with “email” as the database or account key. We stripped all active code when the form was transmitted to the corporate systems.

We needed something global. We needed something online. Click here to see more...

Terminals for NA Expansion

It should be noted that as the online portal gateway being developed was designed as a secure networked terminal for AssuredCard locations across North America. This work was refocused onto an more advanced on-premise online payment gateway developed within AssuredCredit On-Premise Payment Gateway.

Creation of Financial Insitution Registration & Universal Payment Gateway

According to the invention, an intermediary is interposed between a merchant or payee and a purchaser or payor in a commercial transaction, particularly an electronic commerce transaction. The intermediary retains personal banking or credit information of the purchaser or payor. Upon request of the purchaser or payor, the intermediary acquires information regarding the transaction or payment to be executed, and the intermediary deals with securing the appropriate authorization from a financial institution on the purchaser/payor's behalf without the purchaser needing to disclose personal banking information to the merchant/payee. The authorization received from the financial institution is provided to the merchant/payee.

Description of Secure Financial Insitution Registration & Payment Gateway

Universal Merchant Online Payment Gateway Description

In one aspect, the invention is a method of effecting payment between a payor and a payee in an electronic commerce transaction over a communication network, comprising the steps of an intermediary acquiring from the payor personal banking information regarding a financial institution through which payment is to be effected, the intermediary providing to the financial institution banking information regarding the payor and requesting and receiving from the financial institution a payment or credit authorization, and the intermediary informing the payee of said payment or credit authorization.

In another aspect, the invention is a method of effecting an electronic commerce transaction between a purchaser and a merchant over a communication network, comprising the steps of an intermediary acquiring from the purchaser personal banking information regarding a 2o financial institution through which payment for the transaction is to be effected, the purchaser selecting a product or service from the merchant, the purchaser instructing the intermediary to complete the transaction according to a method of payment accepted by the selected merchant, the intermediary informing the merchant that a purchaser wishes to purchase the selected product or service. The intermediary confirms the desired transaction with the purchaser, provides the information to the financial institution, requests and obtains authorization of payment or credit for the purchase price by the financial institution. The intermediary then informs the merchant ,of the authorization. The merchant confirms the purchase order with the financial institution and the financial institution sends payment to the merchant.

In yet another aspect, the invention is a method of facilitating payment in a payor-driven electronic commerce transaction on a communication network, comprising the steps of forwarding to a financial institution a request for authorization of payment or credit comprising personal banking information of the payor, payment amount information, a 1o merchant identification number and a transaction number, receiving from said financial institution confirmation that an authorization number has been dispatched to said merchant, and dispatching to a merchant a transaction number and order information without providing said personal banking information.